The South West – Land, sea, air and rare earths

Regions: South West

Above: With its long runway, Newquay Airport has attracted the likes of Virgin Orbit to the area. Credit: Cornwall Council

From Bristol’s wealth and advanced engineering base, head west to Cornwall whose ancient mining industry is being revived; this time for lithium not tin.

Ruari McCallion

Above: Business Secretary Kwasi Kwarteng took a tour of British Lithium’s pilot plant near Roche in March 2022. Credit: British Lithium

The South West has a long history of marine voyages and exploration. Today, the lure of travel to the high frontier of space is stirring the landscape. The domes of Goonhilly Down, once part of the UK’s early-warning system, have been replaced by the big dishes of Goonhilly Satellite Earth Station (SES), which provides access to all types of commercial satellite and deep space communications.

Cornwall won’t just be monitoring if the consortium behind Spaceport Cornwall has its way. Based at Newquay Airport, the Spaceport is scheduled to see Virgin Orbit start satellite launches during 2022. The launchers are converted Boeing 747 Jumbo jets which carry satellite-carrying rockets under their wings to stratospheric altitude. The plane then returns to Earth.

If Virgin Orbit achieves its aim of starting launches this summer, the UK will be the first country in Europe to do so. Newquay Airport is attractive to satellite launch companies because its runway is one of the longest in the UK at 1.7 miles.

Spaceport Cornwall and Goonhilly SES are not passive bystanders. Aerohub Business Park, co-located with the airport, has Enterprise Zone status and has attracted investment from the Homes and Communities Agency and the European Regional Development Fund.

Among the businesses already located there are Airblade Dynamics, which provides wind turbine blade upgrade services; modular buildings manufacturer CIS UK; and almost a dozen aviation and support service providers.

Aerospace and drones

Elsewhere, liaisons between aerospace manufacturers and the supply chain are encouraged by the West of England Aerospace Forum (WEAF). Among the leading aerospace manufacturers in the region are GKN and Yeovil-based Leonardo, which specialises in the manufacture of helicopters and is a leading player in Project Tempest – the next-generation fighter and ground attack aircraft.

Meggitt, which specialises in components and sub-systems for the aerospace, defence and selected energy markets, was founded in Dorset. It may now be headquartered in Coventry but retains a strong presence at Bournemouth Airport.

A potential spin-off from Project Tempest could be ‘swarms of drones’; up to half a dozen at a time, controlled from a single mobile unit, which could offer more labour-efficient delivery services in the ‘last mile’ in urban areas – depending, again, on the infrastructure and deployment of 5G communications.

BAE Systems and Lockheed Martin both have facilities in Gloucestershire and both happen to be focused on cybersecurity. Lockheed Martin’s Cyber Works Centre opened in 2017 as part of a £3m investment

by the American aerospace giant. BAE Systems facility in Gloucester is one of its five Digital Intelligence sites in the UK, the others being Guildford, London, Leeds and Manchester.

Lithium: the essential ingredient

One development attracting cautiously optimistic attention is the return of mining to the South West, Cornwall in particular. Not the old tin or copper extraction; rare earth minerals, in the particular shape of lithium.

The Faraday Institution has observed that “the most important determinant of the future health of the automotive industry will be whether batteries are manufactured in the UK”. Local deposits of lithium are regarded as essential in establishing domestic battery manufacturing capability, at scale.

Two companies have already engaged in practical work and demonstrations.

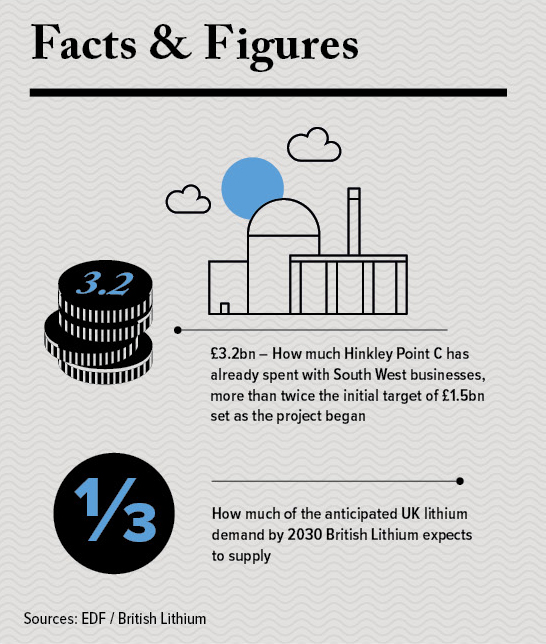

British Lithium has produced lithium carbonate, a key component used in rechargeable batteries for smartphones and electric cars, on a pilot scale from mica in granite at a plant near Roche, Cornwall. The company reports that it intends to create 5kg of lithium carbonate a day in the first part of 2022 and to be in full-scale lithium production within three to five years, by which time it expects to employ 350 staff directly and to have created more jobs in the supply chain.

It expects that the local economy would benefit from an additional £70m per year and the UK as a whole from a home-produced resource capable of supplying one-third of Britain’s likely demand by 2030.

Cornish Lithium, headquartered at the Tremough Innovation Centre in Penryn, Cornwall, has been sampling deep geothermal waters near Redruth. In March 2022, the company commenced drilling operations at its Twelveheads Research Borehole to assess the regional potential of extracting lithium from Cornish geothermal waters.

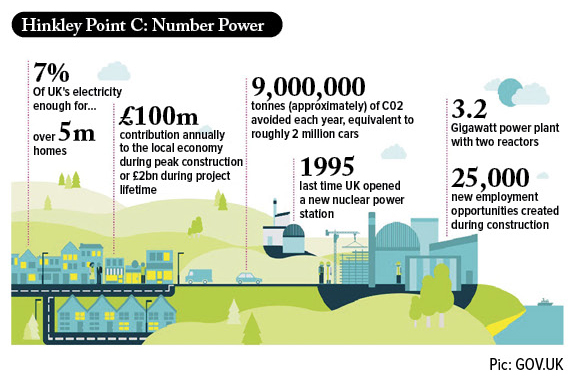

A more established power source is taking its latest shape at Hinckley Point in Somerset. The country’s latest nuclear plant, the £23bn C facility is expected to start operations in June 2026.

The plant will contain two EPR (European Pressurised Reactor) nuclear reactors and have a capacity of 3,200 MWe. The project as a whole is expected to create around 25,000 jobs and once complete, is expected to meet about 7% of the UK’s electricity needs.

News in Brief

- In February 2022, Babcock International opened an Additive Manufacturing centre as part of a new partnership with Plymouth Science Park (PSP). The facility will allow Babcock to ramp up its advanced technology capabilities to address critical needs across the engineering and defence support industry and includes the development of a digital and data skills programme in collaboration with PSP. “The challenge of obsolescence and support chain resilience is key for engineering businesses. That’s especially true for Babcock where we maintain complex and critical equipment over long lifecycles. “Having a manufacturing capability that allows us to direct print what we need, when we need it, in direct collaboration with our customers, means we will be able to create parts at scale, in a more efficient and sustainable way – wherever there is a demand, in any part of our business,” says Dr Jon Hall, chief innovation and technology officer for Babcock.

- Herbs and spices specialist The Bart Ingredients Co has opened a £15m production facility in Bristol after rising demand saw the business outgrow its previous site in Bedminster. The facility is two-and-a-half times larger with two fully automated high-speed production lines installed to increase capacity and efficiency.

- Bristol engineering and manufacturing business Avon Group has completed two acquisitions in two months with the purchase of AntiVibe (Hull) Limited, a specialist manufacturer of power transmission couplings and technical rubber and plastic components, and AcoustaProducts, a leading producer of acoustic foam and rubber products for use in the automotive, medical, air conditioning and packaging sectors. “We have continued to invest, through challenging times, in businesses that can contribute added depth and scale to our existing group offering. Both these businesses allow us to diversity further into new markets and grow the business while other manufactures are doing the opposite,” says group director Mark Rushin.

LEONARDO BIDS FOR NEXT GENERATION

HELICOPTER CONTRACT

Leonardo Helicopters is a big employer in the South West and has been under all its current and previous forms, from Westland, through AgustaWestland, Finmeccanica and now Leonardo.

It employs nearly 3,000 people directly and thousands more indirectly through its supply chain. Additionally, it recruits 60 to 70 apprentices a year through its active training and development programme, from 16-year-old craft technicians to graduate trainees.

Leonardo’s output is primarily for military aircraft. The Yeovil site is home to two Centres of Excellence – for transmission components and dynamic composite components such as rotors – and is the UK’s only ‘total capability’ provider to the UK’s Ministry of Defence and export customers.

Leonardo in Yeovil provides integrated operational support for a wide range of models currently in service, including the Wildcat AW159, an improved and upgraded version of the Lynx Wildcat, which has been in service with the British Army for several years; the Apache AH Mk1;

the Merlin helicopter; and technical support and training for Sea King helicopters that are in use around the world.

Wildcat support contract enters second decade

It was announced at the beginning of April that Leonardo was to commence the next period of the 34-year Wildcat Integrated Support and Training (WIST) contract, originally signed in 2012.

The £360m, five-year contract includes spares provisioning service, three-year scheduled maintenance service, enhanced technical support services including aircraft safety management, and synthetic and ground-based training for aircrew and maintainers for more than 70 AW159s that have already been delivered around the world.

It will secure more than 340 jobs in South West England. Around 70% of the content of Wildcat (and Merlin) helicopters built in Yeovil is manufactured on-site or supplied by British companies.

Medium helicopter bid

The UK’s helicopter supply chain could receive a sizeable lift if Leonardo’s replacement bid for the Army’s Puma HC2 workhorse helicopter fleet is successful. Leonardo’s offer is its AW149 a medium-lift multi-role helicopter, described as being “reconfigurable for a wide range of demanding missions in the most severe operational environments”.

The latest version of the AW149 offers advanced platform and system technologies, equipment and weapons, with a central body and chassis designed for high levels of survivability and crashworthiness. It features Open Systems Architecture, enabling fast, low-cost integration of new equipment and developments.

Ready to fly in months

The AW149 already has an active supply chain; Leonardo says that it can deliver ‘Military off-the-shelf’ aircraft in less than 24 months.

The upcoming contract is for between 36 and 44 aircraft. If Leonardo was to be awarded it, a new production line would be created, which would secure hundreds of jobs directly. Between 60 and 70% of AW149 content by value would be British-sourced. There are no less than 70 companies in the existing AW149 supply chain; nine have been named in ‘Team AW149’.

A successful MoD bid would be likely to raise awareness around the world; Leonardo estimates that it could generate orders for a further 500 AW149 aircraft.

Specialist skills and support

Manufacture of helicopters is demanding and highly specialised.

The gearboxes transmit huge power loads from twin engines, in the case of the Wildcat, and three engines in the case of the Merlin. They are designed to manage complex heat treatment processes. Casings, purchased from the supply chain, are machined in Yeovil.

The main and tail rotor blades are manufactured from composite materials. The Yeovil site has full production capability, according to managing director, Nick Whitney MBE, from weaving the carbon fibre and building a composite spar, to manufacturing the titanium tips and leading edge with an erosion shield. Assembled blades are cured in an autoclave. The skilled workforce is

key to the company’s performance.