A Sector Ready for Take-Off

Sectors: Aerospace & Defence

Above: Project Fresson involves converting a Britten-Norman Islander to run on hydrogen

Post-Covid recovery hopes and government efforts to be a zero carbon aviation pioneer are giving a boost to UK commercial aerospace, with the war in Ukraine certain to increase defence spending.

Murdo Morrison

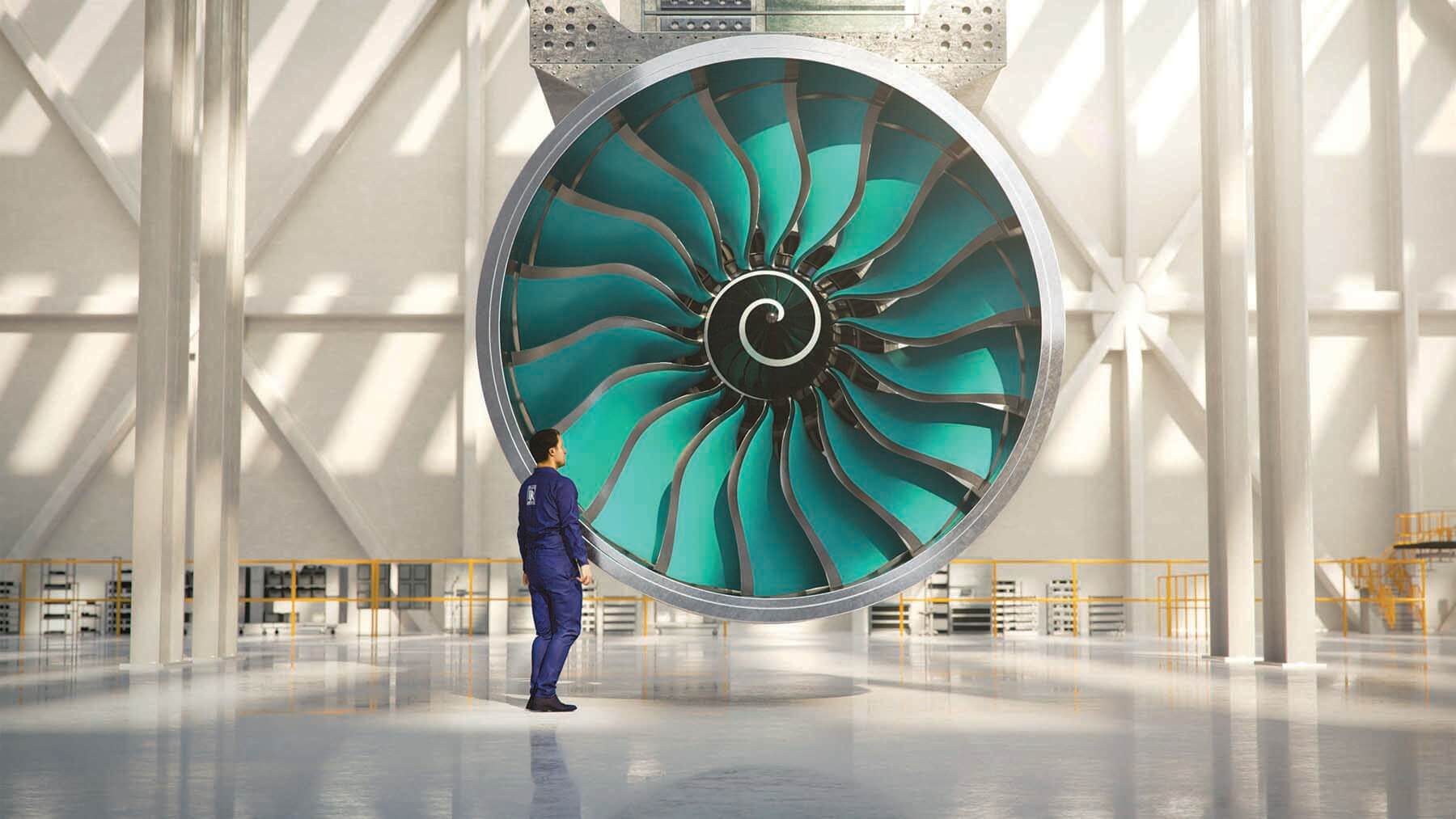

Rolls-Royce’s UltraFan is intended to burn a quarter less fuel than its Trent family predecessors

After two stuttering years, UK commercial aerospace manufacturers began 2022 on course for a robust recovery. With the world flying again, newly cash-positive airlines were rousing themselves from near-hibernation and introducing or restoring services. Aircraft orders and deliveries bounced back in January to pre-pandemic levels or higher.

In fact, the big worry for aircraft makers was that the supply chain could rise to the challenge of producing aircraft at pace again. As the adage goes, ramping up is harder than ramping down. It is more difficult still for an SME that lacks the deep pockets of a multinational to invest in machinery. Skilled staff who left as a result of Covid cuts cannot be replaced in a hurry.

National security

The Ukraine crisis has put a dampener on the optimism. While not an existential threat to aviation and aerospace – unless you are Russian and effectively prevented from flying abroad – the conflict has helped send the oil price and inflation soaring. This is bad news for consumer confidence and airline balance sheets, and will in turn hit prospects for aerospace recovery.

However, as with many international crises, the spotlight has returned to how prepared the UK is to pay for its defence. After the Afghanistan and Iraq interventions, successive strategic defence reviews in 2010 and 2015 slashed spending in real terms, and home-grown programmes such as the BAE Systems MRA4 Nimrod maritime patrol aircraft were axed.

Events in Ukraine show that predicting national security imperatives is as much guesswork as science – even on a five-year horizon. A 2021 review barely noted the threat to NATO from a belligerent Russia. With even Germany’s socialist Chancellor advocating more defence spending, Prime Minister Boris Johnson will remain under pressure to ring-fence or boost the Ministry of Defence’s budget.

Sustainable aviation

While Ukraine has also highlighted much of Europe’s reliance on Russian energy supplies, dealing with the climate crisis will remain a priority, and the UK aerospace sector is expected to play its part. Despite post-Brexit worries that the country would get frozen out of EU projects, the UK has committed to its own ambitious green aerospace research and development agenda.

Those decarbonisation initiatives are known by an array of acronyms or snappy titles, such as HEART, HyFlyer, and H2Gear, and are mostly focused on developing propulsion systems based on electrics, hybrid electrics, or hydrogen fuel cells. How much funding government will continue to commit to and how much serious investment will be expected from industry remains to be seen.

Project HEART (Hydrogen, Electric and Automated Regional Transportation) is aimed at developing a “sustainable and scalable air transport network” for the UK by using aircraft capable of carrying nine to 19 passengers, operating short-hop services from 100 general aviation airfields around the country.

GKN Aerospace is leading H2Gear, which is tasked with devising a hydrogen propulsion system for sub-regional aircraft that could eventually be scaled up to larger platforms. Hydrogen – converted in liquid form to electricity via fuel cells – is one of the Holy Grails of the zero-carbon pioneers because of its potential to provide power while leaving water as its only by-product.

Another, Project Fresson, sees university-affiliated Cranfield Aerospace working with UK airframer Britten-Norman to convert one of its nine-seat Islanders to run on hydrogen fuel cells, with a first flight targeted for 2023. Britten-Norman’s chief executive William Hynett describes hydrogen technology as a “game-changer” that will allow commercial aviation to achieve its zero-carbon goal.

The various sustainable aviation schemes bring together the big names of UK aerospace with SMEs, start-ups and academia in the

UK and beyond. Defence player BAE Systems, for instance, is working with tiny Slovenian aircraft manufacturer Pipistrel to develop an electric-powered aircraft that could be used

to train pilots for the Royal Air Force and other services.

In for the long-haul

Propulsion heavyweight Rolls-Royce has had a rough time of late, with a business model skewed to revenues from in-service maintenance contracts made worse by a pandemic that has especially hit the large-aircraft market it depends on. However, under departing chief executive Warren East, it has invested heavily in sustainable technologies and new product development.

One of its big bets is UltraFan, an engine designed to burn 25% less fuel than the Trent family it is derived from. The Derby firm is assembling its first demonstrator. Despite clarion calls for aviation to urgently address its carbon footprint, Rolls-Royce insists gas turbine engines will remain the “bedrock” of long-haul air travel for some time, and the challenge is to make them more efficient.

However, Rolls-Royce is also addressing the alternative-propulsion area. Together with Brazilian aircraft manufacturer Embraer and Norwegian airline Wideroe, the UK firm is examining ways of developing a zero-emission regional aircraft. Rolls-Royce has also helped adapt a single-pilot racing aircraft to run entirely on battery power as part of a project called ACCEL.

Wingspan

While propulsion technology is crucial to the industry’s zero-carbon drive, wings are vital too. Reducing their weight, and improving their aerodynamic qualities can contribute considerably to the greening of aviation.

The Brexit negotiations prompted dire warnings that Airbus could move out of the UK entirely in the event of a ‘No Deal’. So far, that hasn’t happened and the country continues to be the European group’s wing centre of excellence. The Wing of Tomorrow R&D programme – designed to test the latest composite materials and methods in wing aerodynamics and architecture – proceeds apace.

Airbus UK and its supply chain must convince bosses in Toulouse that the nation remains Europe’s best at designing and manufacturing wings. It’s an argument bolstered by Spirit AeroSystems’ wing plant in Belfast.

The former Bombardier site was set up a decade ago to produce the all-composite wing for the CSeries, which became the Airbus A220. The debt-laden Canadian company was forced to sell its Belfast factory to Wichita-based Spirit in 2020, but it remains one of the most advanced wing production facilities in

the industry.

Lift off for eVTOL

Urban air mobility is another emerging, environment-friendly sector in which the UK is a leader through Bristol-based Vertical Aerospace. In recent years, more than 100 companies – many start-ups like Vertical – have been developing electrically-powered vertical take-off and landing (eVTOL) aircraft. Vertical is one of a handful that have emerged as most likely to succeed.

In December, following a reverse takeover by an investment firm, shares in Vertical began trading in New York. The company is developing a four-passenger product with four tilting rotors at the front and four stowable rear rotors called the VX4. It is designed to transport business people – air taxi-style – over short distances in and between cities, more economically and quietly than a helicopter.

Airlines have shown interest, with Malaysia’s AirAsia committed to acquiring at least 100 VX4s. While the segment must overcome numerous hurdles, not least convincing regulators and potential passengers these revolutionary aircraft are safe to fly, some predict it could be bigger than business aviation by the 2030s. Through Vertical and others, the UK could be a prime mover.

“The various sustainable aviation schemes bring together the big names of UK aerospace with SMEs, start-ups and academia in the UK and beyond”

Above: BAE Systems has been adding partners to its Tempest next-generation combat aircraft programme

Above: The UK remains Airbus’ wing centre of excellence

“Rolls-Royce has also helped adapt a singlepilot racing aircraft to run entirely on battery power as part of a project called ACCEL”