Food and Drink: “Among the most brutal conditions food & beverage sector has ever seen”

Sectors: Food & Beverage

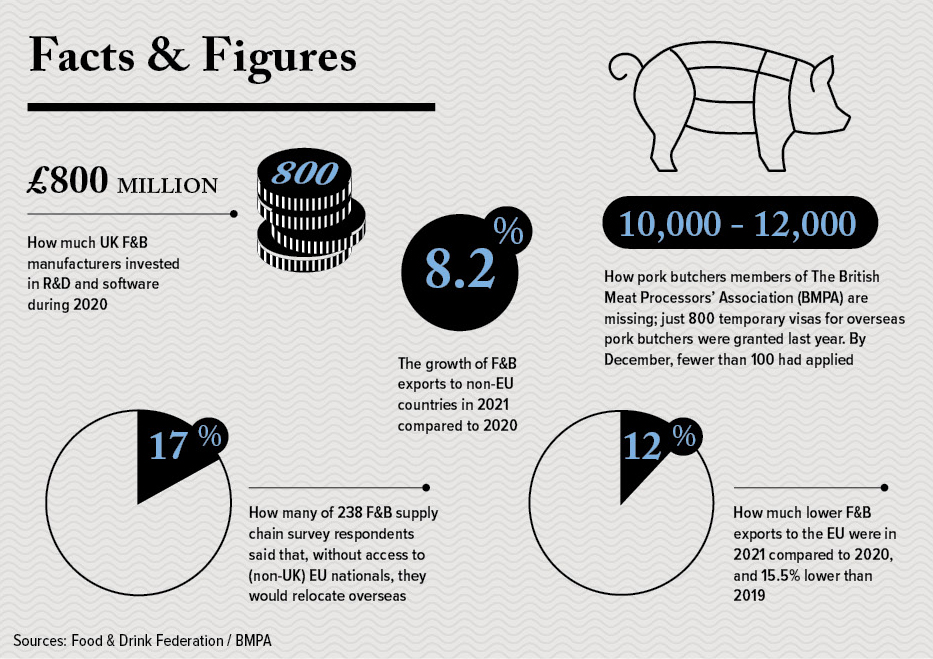

Above: A dwindling slice of the pie: with ingredient supply shortages, raw material inflation, energy cost hikes and reliable labour issues, food companies’ profits are being squeezed. Credit: YesPhotographers – Stock.adobe.com

The food and drink industry is fighting on many fronts, yet innovation, start-ups and continued investment are demonstrating robust resilience.

Paul Gander

Above: The people behind the pies: Higgidy is proud that its food processes are finished by hand and, despite planned expansion, is determined this will remain a key part of its service. Credit: Higgidy

While most parts of UK manufacturing are suffering, to a greater or lesser degree, from inflationary pressures in the supply chain, Brexit-related issues (if they are exporters) and energy costs, the food and beverage (F&B) industry is facing some of its toughest challenges.

On top of these cross-sectoral problems, F&B manufacturing companies are seeing an especially acute recruitment and labour availability crisis, with the troubling potential to limit growth. As we will see, this means that up to 13% of job vacancies across all food and drink related segments of the economy remain unfilled at any one time.

As well as the sustainability and carbon-related issues facing all energy-intensive industries, much of the sector has been grappling with a niche set of reformulation challenges, too. These are a response to new legislation designed to limit the impact of high fat, sugar and salt content on the general population.

Riding the ‘meat-free wave’

Despite all of this, food start-ups continue to proliferate, while manufacturers large and small are investing and expanding. One example is savoury pie and pastry producer Higgidy, which is currently investing £10m in a new site at Shoreham-by-Sea. This so-called ‘Higgidy Village’ is testament to consistent growth of more than 15% CAGR over a decade, says the brand-owner.

“We have recently joined an elite group of chilled food brands each with a retail value of over £50m,” says CEO, Rachel Kelley. “We plan to double the size of our brand over the next five years. Initial capital investment will unlock capacity to take its retail sales value close to £66m.”

In December 2020, Samworth Brothers went from being a minority shareholder in the business to holding a majority stake. But Camilla Stephens, who co-founded the company nearly 20 years ago, remains very much its public face.

Higgidy says its growth has partly been the result of improved distribution and innovation. But shifting consumer preferences, reinforced by the pandemic, and the increasing popularity of plant-based foods have also played their part.

The company’s own data underlines how even ‘mainstream’ food manufacturers can hitch a ride on the meat-free wave. “At the moment, 72% of our range is vegetarian or vegan,” says Kelley. “By the end of 2022, this proportion will hit 75%.” Put another way, this part of its portfolio is expanding at more than 20% year-on-year.

A canny brand-owner such as Samworth Brothers, owner of meat-heavy ranges such as Ginsters, is wise to hedge its bets with a majority plant-based offering such as Higgidys.

With a workforce estimated at 300 last year, Higgidy does not have the staffing headaches of some larger and more diversified businesses. Kelley says; “We have had a challenging time when it comes to expanding our team and recruiting new people, particularly during the last 12-months.” But she reports that the “challenge is lifting”, thanks in part to initiatives such as peer recommendation incentives.

The challenges of recruitment

Continuity of labour is a concern across the sector. Earlier this year, fresh prepared food manufacturer Bakkavor announced it was recruiting across its 23 UK sites. The Food and Drink Federation (FDF) looks at the industry nationally and on the basis of member feedback, its report on labour availability problems published last summer put national vacancy rates at 13%. This would translate as some 500,000 vacant positions across all food-dependent parts of the economy, including farming, road haulage and hospitality, according to the FDF.

These estimates were part of the evidence put to the House of Commons (HoC) Environment, Food & Rural Affairs Committee late last year. It also heard about crops left to rot in the fields due to migrant labour shortages and the culling of pigs, again due to the lack of veterinary and abattoir capacity. While the Seasonal Workers Pilot scheme for horticultural workers has been extended to 2022 and beyond, it is unclear whether this will get close to meeting the shortfall.

Head of industry growth at FDF, Caroline Keohane, says businesses are managing current shortages as best they can to meet demand. “The concern is how these shortages are affecting future growth opportunities and the ability to take on new customer contracts in the longer term,” she says.

“Increasing the uptake of automation is providing part of the solution for some businesses,” says Keohane, adding that technology sales to the industry are visibly increasing.

“Employers are also thinking creatively to attract more people into the sector, including introducing flexible work patterns,” she reports.

While an unspecified list of equipment is included in the shopping list for the new Shoreham site, Higgidy emphasises “the people behind our pies”. “Our food is finished by hand, and this is a point of difference within the category, and something we are proud of,” says Kelley. “Although our site and capacity are expanding, this will remain.”

As the FDF points out, for many other manufacturers, the balance between manual and automatic operations is shifting. Meat and poultry processor Cranswick plc told the HoC Committee it had invested more than £100m over a decade on “reducing the labour needed and the skills required for some of our cutting operations”.

Investing to increase output

At Wyke Farms in Somerset, the challenges of recruiting the necessary staff in a rural area interlock with the need to increase productivity. “Recruitment is quite a challenge,” says managing director Richard Clothier. “Everyone agrees we’re going to have to pay more.” The aim is to combine the upskilling of staff with improved automation. “Our target is to treble output per person.”

At different parts of the butter and cheese operation, this may mean investment in robotics or in enhancing lines for increased output. On the butter side of the business, the focus has largely been on automating packing and washing systems. The latter is as much about energy and water usage as manpower.

“On the cheese side, we’re in the process of building a new dairy,” says Clothier. “This is about increasing throughput levels and automation, including in areas such as cheese cutting and end-of-line equipment.”

Elsewhere, Pukka Pies is investing £5.1m to lift output at its Syston, Leicestershire, plant this year, having invested £4.5m over the previous 12 months. Meanwhile, the company saw turnover increase by more than 9% to reach £58.1m in the year to May 2021.

Investment has not only meant a strengthening of Pukka’s core pie range.

“We recently made a major move in the savour pasty category, with the launch of Pukka

sausage rolls, slices and a pasty,” says CEO Deborah Ewan.

Another business investing in is manufacturing is Weetabix, based at Burton Latimer in Northamptonshire, roots that date back to 1932. The company, which has a sustainability strategy, is committed to maintaining its global centre of manufacturing excellence here.

“Our £16m investment in our site at Corby came to fruition in 2020, as we opened the doors and started production at our new, state-of-the-art factory. This investment forms a key part of our sustainability strategy and efforts to maintain resource efficiency, and straight away it reduced the amount of energy consumed by the line in half,” says a company spokesman.

In 2021, Weetabix agreed a deal with UK-based green energy supplier Smartest Energy to supply its factories with certificate-backed natural renewable energy, generated by wind, solar and hydro-power. The imported renewable energy will supplement the existing on-site power generation that Weetabix has at Burton Latimer and will help to reduce its Scope 2 emissions. The firm has also invested in a capex project to capture and reuse water that becomes steam during its manufacturing process, saving over 1 million litres of water annually.

Automation for high-care tasks

UK Food & Beverage sector manager at KUKA Robotics, Michael Payne, quotes data from the British Automation & Robot Association showing that the number of robots sold into the UK food and drink sector has been increasing by at least 25% year-on-year for the past four years.

In global terms, this sector in the UK remains some way down the list of countries investing most heavily in automation. But interest is gradually moving away from an exclusive focus on generic end-of-line systems, including palletisers, and increasingly towards the high-care parts of the operation, says Payne, where more tailored options tend to be required. Here, automation also requires greater confidence and experience on the part of integrators.

“Overseas markets such as the US and Australia have adopted more of the technology in this high-care area,” he says. “But we’ll see more of this in the UK in the near future.”

Robotic automation has many different elements within it, of course, and developments in areas from ‘end effectors’ (such as grippers) to vision systems have supported overall growth. “For example, there are systems which gently handle and orientate exotic fruits ready for trimming, and others which use 3D scanning to position a label,” Payne reports.

At the agricultural and horticultural end of the supply chain, says KUKA, progress with automation has been slower. As a representative of the National Farmers’ Union told the

HoC Committee, the range of “exciting” technology currently emerging was likely to “supplement labour rather than replace labour” in the sector.

But there are upstream agri-food applications which have seen greater success. One of these is used in dairies when cows are milked, according to KUKA. “Sophisticated vision locates the teats on the cow’s udder and ensures they are sprayed with disinfectant,” says Payne. “It’s a serious welfare issue for the herds. Dozens of these systems have been sold globally.”

Long-term support would alleviate uncertainty

One of the barriers to increased investment in robotics, of course, has been cost. But increasingly, suppliers are offering financing options to ease this burden and, effectively, allow manufacturers to ‘try before they buy’. KUKA has recently begun to offer such options, says Payne. “Customers can rent a robot at a price comparable to the cost of manual labour, and this comes under operational rather than capital expenditure,” he points out.

These financing options will increasingly influence the uptake of automation at the agricultural and horticultural end of the supply chain, as well as in high-care food manufacture, Payne predicts.

Regarding broader challenges and opportunities in the sector, Keohane at the FDF warns; “A long-term strategy on labour and technology is needed that helps us to attract, retrain and upskill our workforce, and which supports smaller businesses to invest.” The FDF will continue to work with government, skills providers and across the supply chain to attract and retain fresh talent, she says.

Of course, there are other concerns. “There is a huge amount of uncertainty about the year ahead, with fierce pressures for all UK business surrounding inflation and security of supply,” says Pukka’s Ewan.

She talks about “some of the most brutal trading conditions the industry has ever seen”. But as for many others in the industry, the company’s resilience and ambition are holding firm – along with the investment to back them up.

News in Brief

- Start-up Mona Island Dairy on Anglesey, Wales, is set to become Europe’s first zero carbon emissions cheese plant. The £20m investment includes a £3m grant from the Welsh Government.

- UK Export Finance has put its weight behind ‘eight figure’ funding from HSBC UK for Scotland’s Denholm Seafoods. This will help fuel expansion into European and Asian export markets.

- Soft drinks business Radnor Hills will add 27 apprentice places and 20 further full-time posts to its 230-strong workforce this year. Already, more than 90 staff have completed apprenticeships during the past four years, the company says.

- Poultry processor Avara has been investing steadily in automation, with plans announced at the beginning of the year for £12m to finance new production due to be completed by the end of 2022.

- Sales for gut-healthy cereal brand Bio&Me catapulted from £1m to £3m in 2021 and are set to triple again during 2022. New investors, among them England soccer captain Harry Kane, have brought in fresh funding of £1.35m.

- Aluminium can manufacturer Ball Corporation has begun building what is soon to become the largest drinks packaging plant in the UK, with 200 jobs promised for the 56,000 sqm factory in Northamptonshire. Due for completion in January 2023, more than one billion fully recyclable cans will be made there in its first year of operation.

“Higgidy says its growth has partly been the result of improved distribution and innovation”

Above: After a £16m upgrade in 2020 at its Corby plant, Weetabix is now investing in renewable energy and steam capture to save CO2 and water usage. Credit: Weetabix

Above: Packing lines at Wyke Farms in Somerset. Credit: Wyke Farms

“Employers are also thinking creatively to attract more people into the sector, including introducing flexible work patterns”

Above: Milking the herd just got a whole lot easier, using KUKA’s sophisticated vision technology which locates and cleanses cow’s udders. Credit: KUKA robots

Below: KUKA has seen a 25% YOY increase in the number of robots sold into the F&D sector. Credit: KUKA robots

“There are systems which gently handle and orientate exotic fruits ready for trimming, and others which use 3D scanning to position a label”

Above: Carey Causey, Ball Beverage Packaging EMEA President and Jason Bridger, Plant Manager of Ball Corporation’s new site at the SEGRO Park Kettering Gateway. Credit: Ball Corporation